When an individual has been involved in an accident caused by someone else’s negligence and sustained injuries, that person deserves compensation for those damages and losses. This compensation may be awarded in court or through a settlement agreement with the at-fault party’s insurance.

One of the most frequent questions asked regarding these settlements is whether or not they are taxable as income and need to be reported to the IRS. At OEB Law, our team of experienced attorneys can help you understand the tax rules regarding these settlements and what is actually tax exempt.

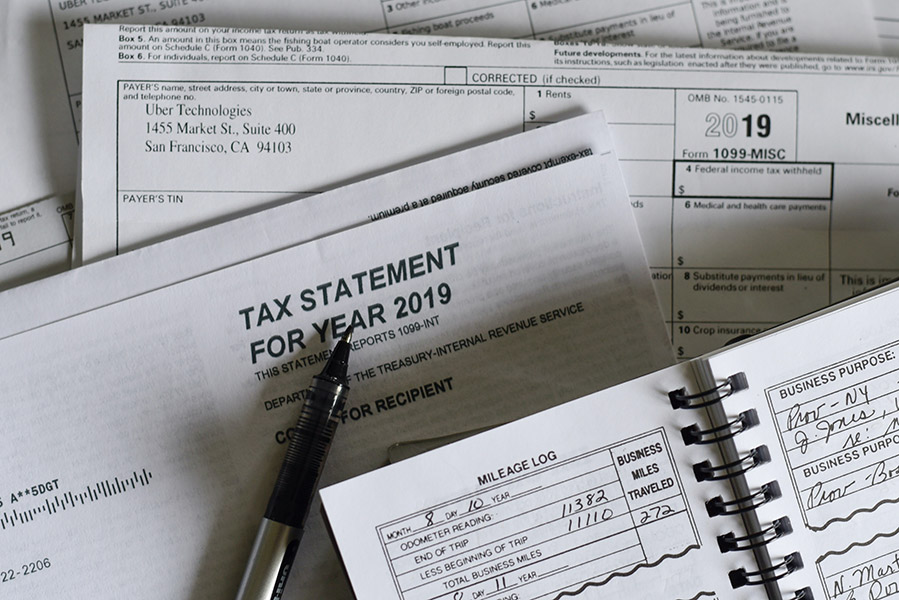

Insurance Settlements and Taxes

As a general rule, insurance settlements from personal injury claims are considered tax exempt because there is no net gain or profit to the injured party from the compensatory damages awarded. However, there are important exceptions to this rule, so it is certainly worthwhile to discuss these exceptions with your attorney.

Before you sign any settlement agreements or accept any money, be sure you are aware of your tax obligations related to this settlement. Our attorneys will walk you through the entire process and ensure that you are always making well-informed decisions every step of the way.

No Content shall be considered Tax Advice. The sole purpose of this report is for informational purposes. Always consult your tax professional, accountant or CPA for your unique tax situation.

To Schedule a Free Consultation With an Attorney to Discuss Your Case, Fill Out the Form Below or Call OEB Law, PLLC, at (865) 546-1111